Read more: What Are Operating Expenses? (With Examples) Examples of G&A expenses Overhead could consist of the cost of the glass, polish, metal framing and other materials.

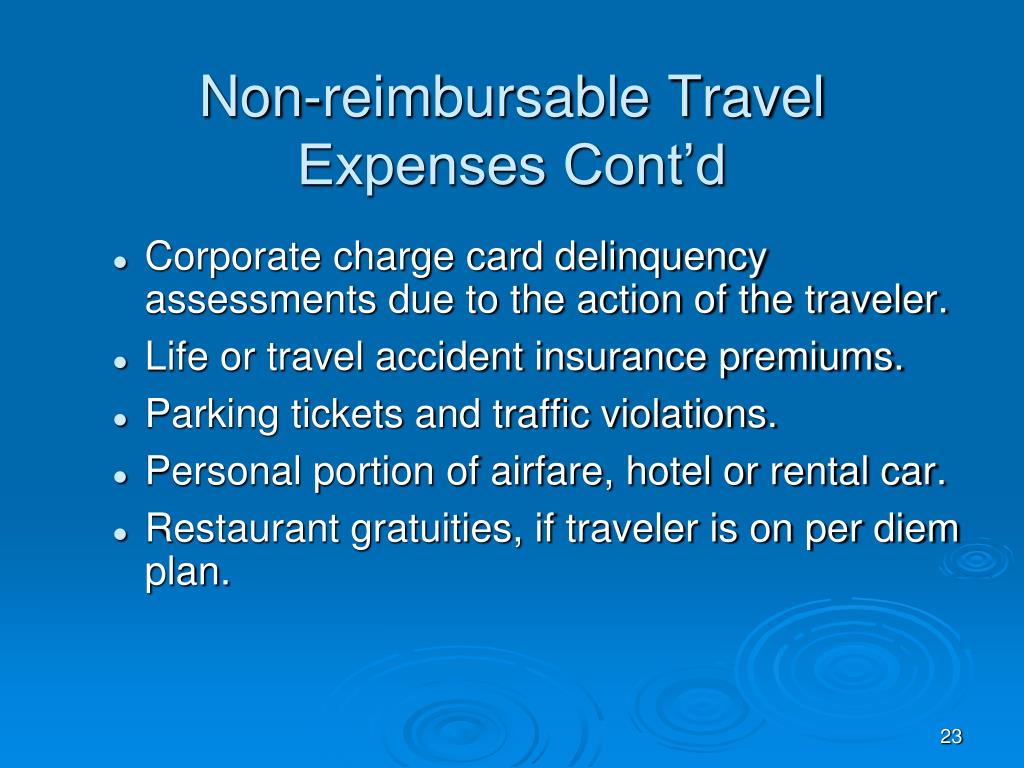

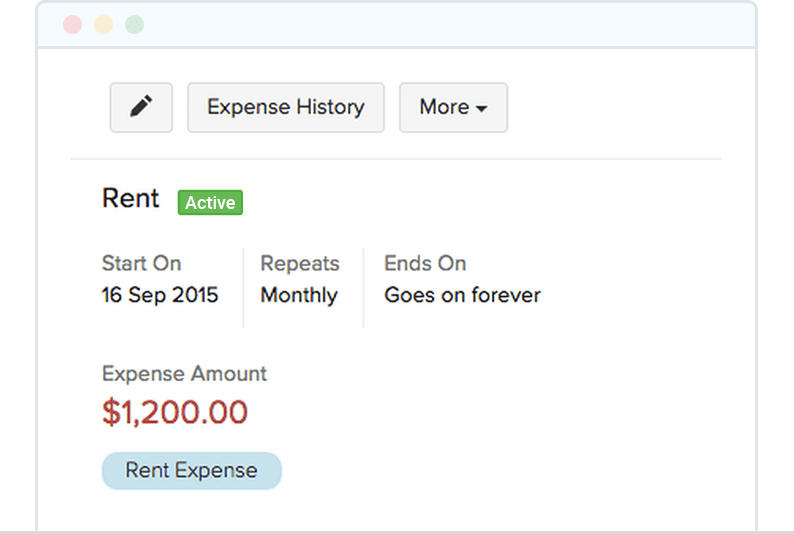

For instance, if an individual owns a stained-glass workshop, G&A expenses could include renting the studio. G&A expenses include rent, insurance, utilities and other day-to-day business costs. Overhead specifically pertains to the costs of producing a good or service or completing a task. G&A costs accrue regardless of whether a company is working on a project. While G&A is similar to overhead, the terms differ: Also called indirect costs or G&A expenses, are fixed, which means they remain the same regardless of how much or little a company makes in sales or other production metrics. General and administrative expenses comprise a portion of a company's operating costs and typically apply to the entire company rather than one facility or department. What are general and administrative expenses? Reducing a company's G&A expenses by moving an office to a less expensive facility or making the workforce remote can help increase its profitability. Types of G&A expenses include building expenses, salaries and wages, insurance, licenses and fees and supplies. General and administrative expenses are accounting terms that refer to a company's operating expenses that stay the same regardless of sales or production levels.

Non reimbursable expenses meaning how to#

In this article, we define general and administrative (G&A) expenses and share examples, along we review tips for reducing these expenses, how to calculate them and why they're important, plus we go over SG&-or selling, general and administrative-expenses. If you want to work in accounting, finance or a related field, you may benefit from learning about this topic. Business expenses often include costs that relate to selling products, such as marketing costs, and costs that remain fixed over time. When tracking or managing a company's expenses, it's crucial to understand the major categories of costs.

0 kommentar(er)

0 kommentar(er)